Five years on from Lehman Brothers’ collapse and “where did it all go wrong?” analysis is all the rage. Answers have varied: poor regulation, malicious bankers, dozy politicians, greedy homeowners, and so on.

But what if the answer was in our minds? New research published in the journal Neuron suggests that market bubbles are in fact driven by a biological impulse to try to predict how others behave.

Any analysis of the global financial crisis would be incomplete without a thorough understanding of the asset bubble that preceded it. In the run up to 2008, property prices hit dizzying levels, construction boomed and the stock market reached a record high.

‘Mania’ is a more useful word for this phenomenon than ‘bubble’ as it implies people getting carried away.

Economists have long picked over the causes of bubbles. But researchers at the California Institute of Technology wanted to know whether neuroscience could tell us anything about why so many people kept inflating the bubble to irrational levels.

Benedetto De Martino, now at Royal Holloway University of London, is one of the study’s authors. “For a long time,” he said, “the study of how people actually made decisions was not considered important.”

“It was always assumed people were rational and wanted the best for themselves. But this didn’t match with our observations of how people actually acted in many situations. Now, thanks to advances in neuroscience, we can begin to understand exactly why people behave as they do.”

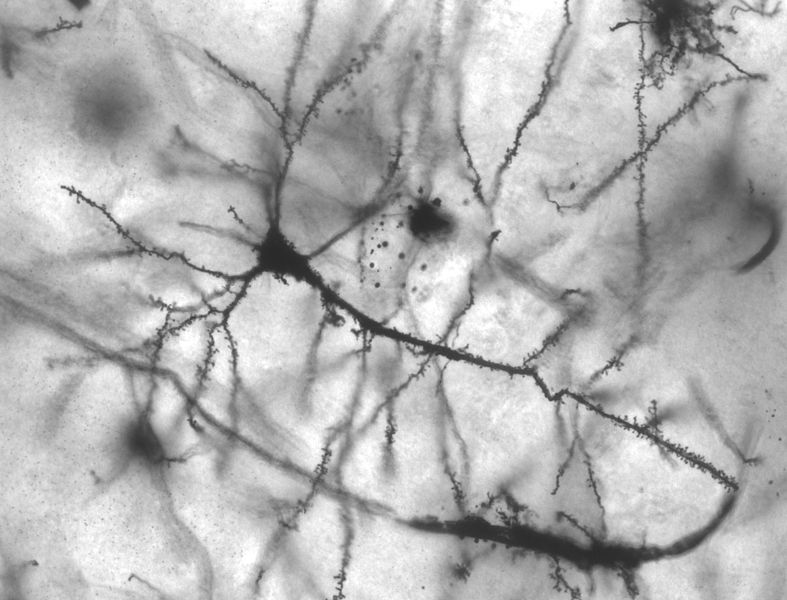

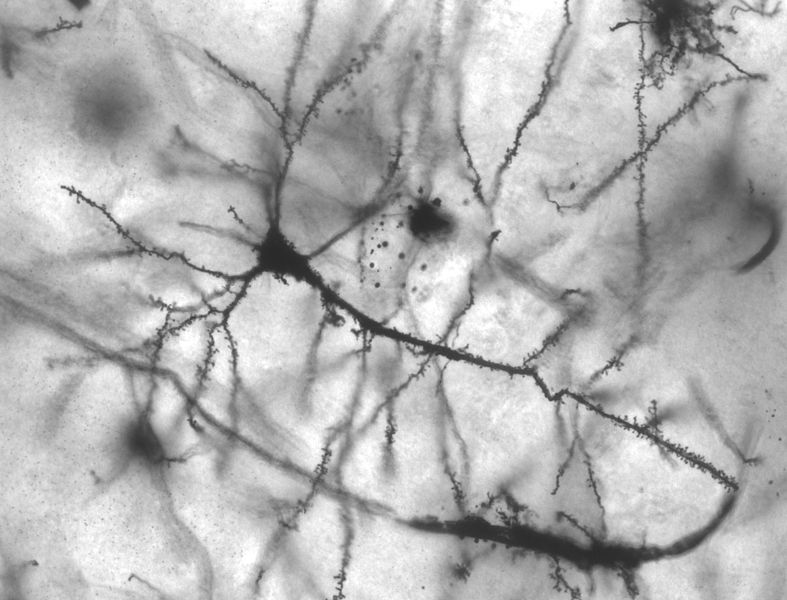

This new field, known as neuroeconomics, combines traditional economics with insights on how the brain works. To conduct the research, De Martino, a neuroscientist, teamed up with finance professor Peter Bossaerts and Colin Camerer, a behavioral economist. Collaboration between these academic disciplines was key.

The study asked participants to make trades within an experimental bubble environment, where asset prices were higher than underlying values. While making these trades, they were hooked up to scans which detected the flow of blood to certain parts of the brain.

They found two areas of the brain’s frontal cortex were particularly active during bubble markets: the area which processes value judgements, and that which looks at social signals and the motives of other people.

Increased activity in the former suggests that people are more likely to overvalue assets in a bubble. Activity in the latter area shows participants are highly aware of the behavior of others and are constantly trying to predict their next moves.

“In a bubble situation, people start to see the market as a strategic opponent and shift the brain processes they’re using to make financial decisions,” De Martino said.

“They start trying to imagine how the other traders will behave and this leads them to modify their judgement of how valuable the asset is. They become less driven by explicit information, like actual prices, and more focused on how they imagine the market will change.”

“These brain processes have evolved to help us get along better in social situations and are usually advantageous. But we’ve shown that when we use them within a complex modern system, like financial markets, they can result in unproductive behaviour that drives a cycle of boom and bust.”

But not everyone agrees with the findings of this study. Richard Taffler from Warwick Business School points out that bubble markets exist in a social context that is difficult to replicate in a lab experiment.

“In the real world there are lots of actors – investors, the media, pundits, politicians – all unconsciously colluding together to create a desired reality,” he said.

In the case of asset pricing bubbles such as the property market in the last decade, or the dotcom boom of the late 90s, everyone has a vested interest in maintaining this unconscious fantasy.

For Taffler, understanding how the brain processes these decisions is useful but still, “a few stages removed from the reality of a real market environment in the middle of an asset pricing bubble.”

“‘Mania’ is a more useful word for this phenomenon than ‘bubble’ as it implies manic behavior, with people getting carried away.”

But this research is just the beginning, and it is clear that the overlap between neuroscience and economics will yield some important insights into human behavior. As De Martino points out, markets are made by people, not numbers, and the human brain has been around for far longer than any financial market. To understand the market, we must understand the brain.

This article was originally published at The Conversation. Read the original article.