In an effort to “stabilize” global oil prices in response to the Russian invasion of Ukraine, the Biden administration, along with a number of European and Pacific Ocean countries, announced plans this week to sell 60 million barrels of petrol from national stockpiles.

The US will contribute 30 million barrels from the Strategic Petroleum Reserve, a massive cache of federal fuel established after the oil crisis of the 1970s. The reserve sits in a series of underwater caverns along the petrochemical corridor of the western Gulf of Mexico, and allows the US Department of Energy to squirrel away crude oil to dispense when supplies are disrupted.

The US tapped the reserve in November, as pandemic turmoil drove the price of a barrel of oil above $85, after years of hovering around $50. But following the Ukraine invasion in late February, global panic that Russia’s massive oil reserves would be closed down sent prices climbing again. Currently, a barrel of oil costs more than $100.

The world hasn’t imposed direct energy sanctions on Russia, although the country’s fuel exports have slowed because of other restrictions. So, the released oil won’t directly replace missing supplies. But it does represent a first step in what could either be an embrace of more oil production, or a retreat from volatile fossil fuels.

“It’s better than what [Biden]’s done in the past—he did not call for an increase in production,” says Kassie Siegel, director of the Center for Biological Diversity’s Climate Law Institute.

According to calculations by the Center’s climate science director, the 30 million barrels represent about the same greenhouse gas emissions as four coal-fired power plants running for a year. But more importantly, says Siegel, it’s a Band-Aid on massive swings in the oil market. “Left to its own devices, the industry is going to try to open up new reserves. Then inevitably, prices are going to crash down again.”

Why the US relies on stored oil

In theory, American fossil fuel companies have the reserves they need to produce more oil in response to high prices. Over the past two years, the Biden administration has issued more federal oil and gas drilling permits than the Trump administration did in the same time period. But companies have said that they either can’t, or won’t, increase oil output in response to rising prices.

In a February interview with Bloomberg, Scott Sheffield, CEO of one of the US’s biggest fracking firms, Pioneer Energy, said that it intended to grow relatively slowly—5 percent at most—over the next several years, in spite of rising prices. Sheffield said that Pioneer would “stay with our plan … regardless of whether it’s $150 oil, $200 oil, or $100 oil.”

“I just don’t see US production contributing the amount of barrels as it has over the last several years,” he said. (He said in a later interview that the company could be open to changing its plans as part of an industry-wide strategy.)

That’s partly because drillers can’t get steel tubing, drilling materials, and workers because of the labor shortages and shipping problems during the pandemic. But it also goes back to longstanding trends in US oil and gas production. From 2014 to 2020, American fracking companies tapped a massive amount of fossil fuels, turning the nation from an oil importer to an exporter. But during that time, the industry as a whole wasn’t profitable, says Clark Williams-Derry, an energy analyst with the Institute for Energy Economics and Financial Analysis, which studies the transition to renewables. It cost more to frack than companies could make selling the product, and whenever they drove down costs, the price of oil dropped, too.

[Related: What a key natural-gas pipeline has to do with the Russia-Ukraine crisis]

By the beginning of the pandemic, when oil buyers were paying others to take unwanted barrels off their hands, 600 American companies had gone bankrupt, incurring a total of $70 billion dollars of debt.

Now, says Williams-Derry, “[the remaining companies] absorbed the lessons of the great shale financial meltdown, and they are not increasing production.”

If anything, they can make good money drilling oil while prices are high—Bloomberg reported that fracking groups were already on track to make record profits before oil prices topped $100 a barrel. “I don’t want to call it profiteering, but this is the moment they’ve been waiting for,” says Williams-Derry.

In spite of those oil industry statements, global analyst Rystad Energy predicts that US fracking output will grow by about 2 million barrels per day over the next year, noting that ExxonMobil and Chevron have both signaled plans to expand in the oilfields of West Texas and New Mexico.

The limits of the Strategic Petroleum Reserve

For the moment, that leaves the US with the Strategic Petroleum Reserve.

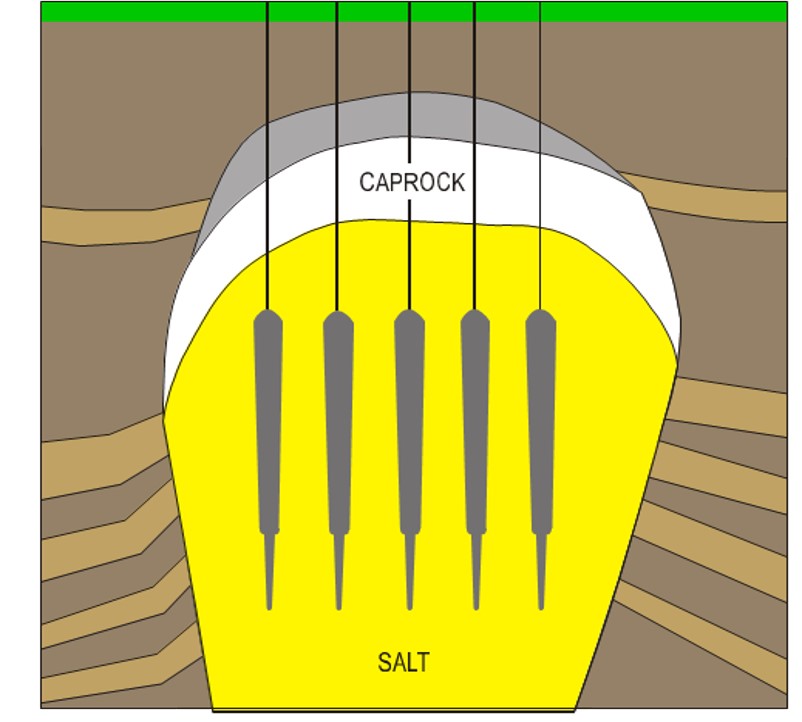

The caverns of the reserve are something of a geological marvel. They begin with salt-domes, the remains of a buried Jurassic seabed that have pushed through the rock above like mushrooms on a forest floor. The domes happen to be the source of much of the Gulf’s fossil fuel deposits—oil and gas pool under awnings in surrounding rock. But the reserves themselves were carved out by humans by blasting water straight down into the salty cores.

According to the Department of Energy, the average cavern is 2,500 feet tall, big enough that temperature differences between the top and bottom cause the liquid fuel to circulate constantly. The largest of them could hold the One World Trade Center with room to spare.

When oil is plentiful, the Department of Energy slowly fills the caverns with unrefined crude. (Oil companies sell to the reserve directly, or send fuel in lieu of payment for drilling on federal land.) When supplies are disrupted, often by a hurricane, it can pump water into the caverns, sending petroleum to the surface for refining.

Across four sites on the Texas and Louisiana coast, the caverns hold close to 600 million barrels of crude oil—more than half of the country’s total crude oil stocks. So while the 30 million barrels that the Department of Energy plans to release is just a fraction of the total, it’s also the maximum that the US is allowed to sell at once. Last November, 50 million barrels were pumped from the reserve, but the majority were loaned out, rather than sold.

Currently, the US produces around 10 million barrels of oil a day, which means the latest release will be less than a percentage point of annual output. But Williams-Derry says oil prices tend to respond to relatively small shifts in supply. “Small percent changes in storage drive prices—you’d think it would be, oh, we’re 10 percent short, but no. If we’re a little bit short, traders start bidding up the price.”

The future of US oil

Still, experts don’t think that the release will make a huge difference for the price of oil, given the massive uncertainty with Russian oil supplies.

“I think that this 30 million barrel release was largely symbolic,” Siegel says. “The only way to get rid of oil and gas volatility and to protect people from price spikes or suffering is to get off oil and gas.”

Not every climate advocate thinks that the release was a bad decision. “We’re supportive of President Biden’s actions to ease everyday Americans’ energy burden in the short term,” Kelly Sheehan, the Sierra Club’s senior director of energy campaigns, writes in a Twitter direct message. But, she adds, “this step should be paired with actions to address the broader problem of our reliance on risky, volatile fossil fuels. The fossil fuel industry and their supporters in Congress are seeking to exploit the current crisis to justify a massive, long-term buildout of fossil fuel infrastructure that would lock in dependence on oil and gas for a generation.”

[Related: How publicly-owned power could shape the future of clean energy]

Siegel points out that there is another immediate approach: The Biden administration could tackle the immediate harms of high oil prices from the demand side, rather than supply. “Give people direct relief as Congress did during the pandemic,” she says, referring to the stimulus checks. But, she says, the only way to shield customers from further volatility in the long term is “a bold plan to get off oil and gas as quickly as possible.”

That would mean rapidly weatherizing buildings, accelerating the transition to electric vehicles, and pushing manufacturers to produce more heat pumps and other replacements for fossil-fuel infrastructure. That’s the direction Europe is taking as it scrambles to reduce its reliance on Russian gas. And while it’s true that all those steps take time, so does building more fossil fuel capacity.

“This week with the Strategic Petroleum Reserve is not determinative of the future,” says Siegel. She also says that investors and oil companies have sunk money into enough fossil fuel production to overshoot the targets of the Paris Agreement. Whether the US doubles down on oil production, or moves to alternative energy routes of energy—that could be the fork in the road.